Why?

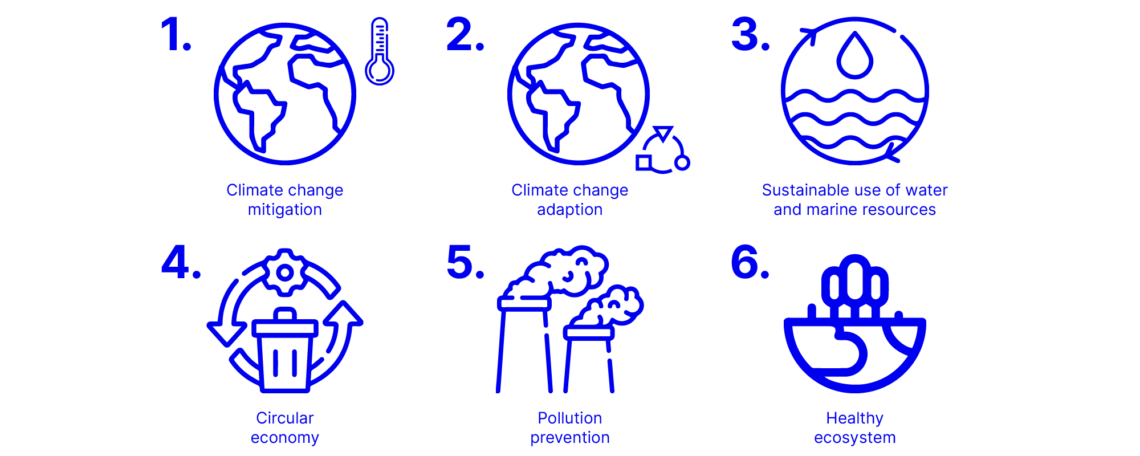

To qualify as green, an investment would need to contribute to at least one of these six objectives and must do no significant harm to the other objectives.

According to the United Nations Environment Programme Finance Initiative (UNEPFI) report, there are no tools or databases today to assess climate change mitigation and adaptation.

The complexity of the challenge is the lack of clarity on how to aggregate and validate data from different standards to assess compliance with environmental and climate criteria in a way that is universal and independent of the audit service provider.

What?

The Sustaxo team aims to create a solution, which would make it easier for financial institutions and large companies to produce the required analyzes and reports and at the same time would also be available and comprehensible to small businesses.

The solution directly contributes to the necessary changes in the field of economy and climate set out in the ‘Estonia 2035’ strategy. More specifically to the increase of cooperation between entrepreneurs and the public sector through the development of joint innovation platforms and data economy.

How?

Following the principles of the real-time economy, we bring together data from the company itself, from it’s partners and from public sector databases with the least administrative workload. This way the green turn creates a competitive advantage for Estonian companies instead of obstacles.

As a result:

- Sustainable taxonomy evaluation becomes standardized and public sector validetad.

- Data inquiries and analysis from both private and public databases becomes efficient and accessible.

- Environmental sustainability reporting gets integrated into investment decisions and policy making.

What does this mean for Estonia?

Reporting on the taxonomy of sustainable financing will become a country wide standard and evaluation of compliance will be available to all Estonian companies. This will in turn give them a competitive advantage over other EU companies and increase the chances of receiving green investments.

The public sector will start receiving real-time overviews of who contributes to the achievement of national environmental and climate goals, which will help turn sustainable business into the new norm and common practice.

Did you know?

- In order to prove their compliance with environmental and climate objectives and taxonomy, financial institutions must collect data on their entire portfolio, which is not only time-consuming for the bank, but also costly and complicated with today’s solutions.

- According to the European Investment Bank survey, Estonian companies are about three times behind the EU average in setting climate goals and plan to invest only half as much into the green turn.

- According to a study by UNEPFI and the European Banking Federation, the taxonomy of sustainable financing affects more than 50% of a typical bank’s balance sheet/income.