In practice, above mentioned involves all persons, eg. while opening a bank account, doing notarial transactions, applying for a loan, transferring fund online, entering insurance contract, etc.

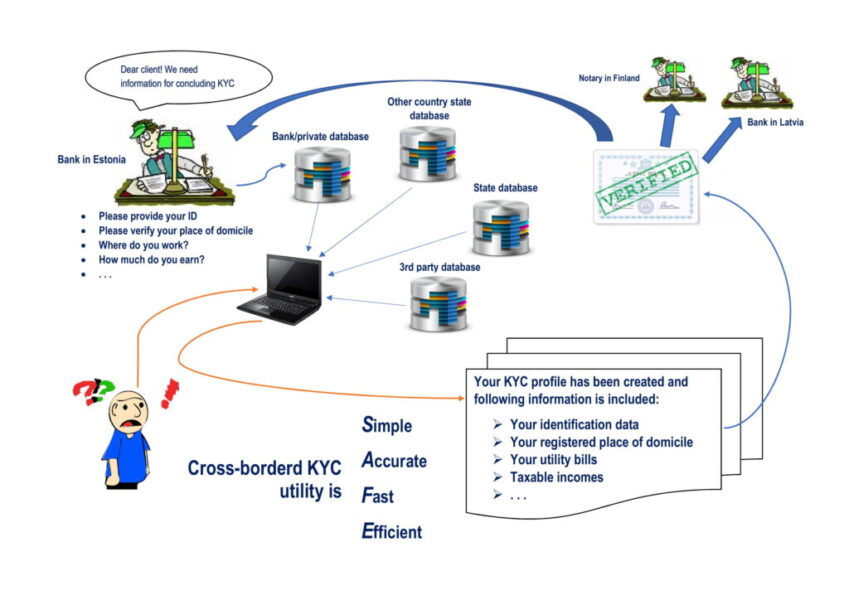

We will build a person ́ KYC (Know Your Customer) profile, where the most common data for conducting KYC will be automatically collected from:

- State databases, which shall give to such data high trustworthy (virtual state stamp of accuracy).

- 3rd parties’ databases, such as sanctions list, international “blacklist”, PEP registers etc.

- State databases from another country.

- Private (i.e. bank) databases.

Also, the person itself can upload additional files and information. The profile already created is interoperable, having different layers (with different content of information) for different obliged entities (i.e. banks, notary, etc.) and the person itself can choose with whom to share its profile. This profile will be a platform/app which shall be created by the private sector or State.

Problem description

Currently the KYC process is suffocating the economy, for example non-residence are not able to open banking accounts, companies banking account with foreign backgrounds are being closed, rules have been tightened, bureaucracy has multiplied, which has lead foreign investors and startups to run away.

How the KYC is done today:

- Every obliged entity does it in its own way

- Obliged entities spend annually hundreds of millions of euros for KYC checks

- There is no single standard or standardization

- The same data is asked again and again

- A lot of information is collected in paper and in vis ́a ́vis meeting and such data is not machine-readable

- The state has most of the data needed for KYC, but it is not accessible

- Obligated entities do not share their KYC data

- There are legislative gaps which do not allow to collect and exchange KYC data online

- There are no regulations existing which allow using of KYC data cross-border.

Solution

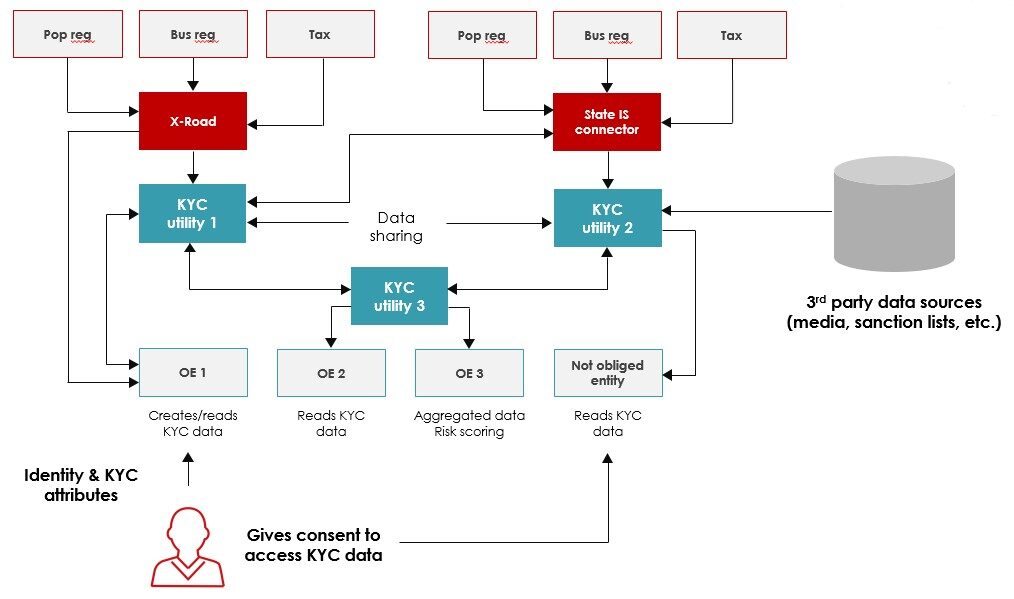

An application / portal that allows you to create KYC profiles that automatically collect the most common KYC data from various databases, incl. national databases, which thus carry a so-called ‘nationally validated data stamp’, so that data no longer need to be re-checked. The portal mediates data between the state, ie. national and external databases, and obliged entities and between obliged entities themselves. An existing profile is reusable (interoperable) and the person can choose who to share their profile with.

The person will identify itself in KYC app, the app creates KYC profile by collecting all sufficient data from state and other databases, and then a person will choose with whom to share it. The person can always monitor to which data and to who it has given access and always withdraw is consent for sharing data

With a push of a button!

To great a KYC profile and to share your profile all it takes is a push of a button.

Impact

With this solution we will reduce the resource for collecting and analyzing data and for transmitting data (we help to save time and money) and will encourage automated data management and analysis (eg. XBLR GL), leading to better and more accurate risk prevention and risk detection. Speed of data collection and data quality (and reliability) is much higher and faster with the more accurate response, bringing to less additional movements and bureaucracy. And finally, the more effective is the risk detection and risk prevention, then more reliable is the country.

Why this solution is different from other solutions already existing in the market?

- The person itself initiates his / her own KYC data collection and this data is already collected and transmitted in a pre-grouped form (profiles)

- The profile is always up-to-date. Whenever obliged entity has the need to see this KYC data, it is always the current data

- The profile is orientated to use original sources (eg. data that state has collected/created)

- The technical solution also allows data exchange in between obligated entities (eg. data about beneficiaries, PEP, the actual place of residence) ie. if any obligated entity has collected data that was previously missing or changed, that data is visible to other obligated subjects

- The technical solution allows returning data back to the state (eg. real residence data in the population register)